Some information on how to set up multiple currencies within QuickBooks and how that impacts Acctivate.

Acctivate supports multicurrency transaction when integrated with a QuickBooks company that has multicurrency enabled.

The steps to get started with multicurrency are generally the same for QuickBooks Desktop and QuickBooks Online:

- Enabled multicurrency in QuickBooks

- Define your home and foreign currencies

- Download the current exchange rates

- Setup A/R and A/P GL accounts for the currencies you sell and purchase in

- Sync Acctivate and QuickBooks

QuickBooks Online creates the required A/R and A/P accounts when you first transact in a currency. This means that in QuickBooks Online you may need to create a "dummy" sale or purchase transaction for each currency that you have enabled if you haven't completed a transaction for that currency before.

Once you've created the transaction, the necessary GL accounts will be created. In Acctivate, perform a sync so that the new foreign currency GL accounts are available for use in Acctivate.

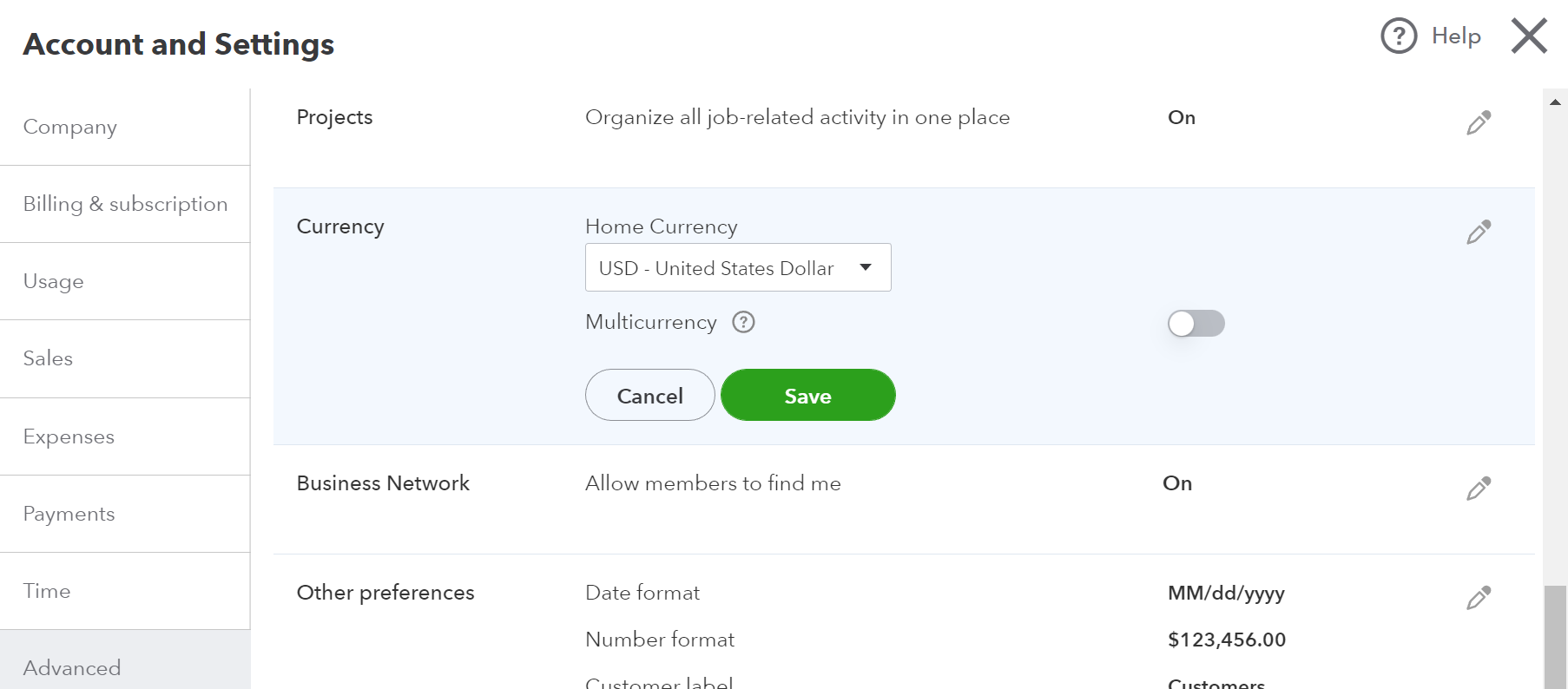

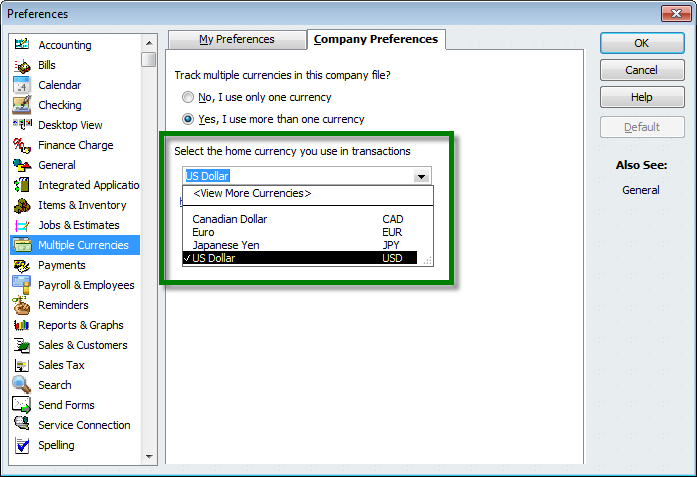

Home Currency

Multiple currencies is setup first in QuickBooks and then synced over to QuickBooks. Please see Intuit's official article about enabling Multi-Currency in QuickBooks.

A single Home Currency is defined when multiple currency is first enabled in QuickBooks Preferences. The home currency is usually selected for your country (e.g., USD in the United States, CAD in Canada).

Inventory, Revenue and Cost of Goods Sold are always converted and posted in Home Currency. This includes customer and/or vendor transactions that were entered in a foreign currency.

Currency Codes and Exchange Rates

The Currency Code list is managed by QuickBooks and synchronized to Acctivate. You can choose from over 150 standard currencies..

Exchange Rates can be updated in QuickBooks Desktop as often as you like (either by downloading the current exchange rate or defining your own exchange rate), while QuickBooks Online exchange rates are automatically updated every four hours, but you must sync to update the rates in Acctivate.

New transactions entered in Acctivate will use the current exchange rate, but you can manually override the rate for back-dated transactions.

Customers and Sales

A specific currency code must be selected for every customer. All transactions for that customer must be in that single currency. You cannot change the currency code when there are transactions for the customer. You will need to create a copy of the customer to use in other currencies.

Each Acctivate Branch will be assigned to a specific Currency. You can create multiple Branches for a single currency, but Acctivate requires a branch for every currency that is in use.

Prices and Amounts on Sales Quotes, Orders and Credits for the customer will be entered in the customer’s currency. However, you may toggle the sales order window to view prices and amounts in the home currency.

The current exchange rate will be captured when the sales order is first created. You can update it at any time using the refresh button adjacent to the exchange rate. This exchange rate will be used when calculating revenue in the home currency.

The gain or loss on currency is created in QuickBooks when you process and deposit the customer’s payment(s). The exchange rate on the payment and deposit do not update the exchange rate on the sales invoice.

Product Prices

The primary list price for a product will be defined in the home currency. Acctivate also supports an additional list price for each currency. Simply enter the additional prices on the Product Information Prices tab, selecting the appropriate currency code. Acctivate uses the price(s) for the customer’s currency, rather than re-calculating from the home price(s) based on exchange rate fluctuations.

Vendors and Purchasing

Similar to customers, all transactions for a vendor must be in the vendor’s single currency. Purchase Orders, Landed Cost and Inventory Receipts will be displayed in the vendor’s currency by default. You can also toggle these windows to display the prices and amounts in home currency. If a vendor sells in multiple currencies, you will need a create a seperate copy of that vendor in QuickBooks and then sync it to Acctivate.

The Prices on the Vendors tab of the Product Information will be entered or imported in the vendor’s currency. The exchange rate will convert their foreign prices to your home currency for inventory.

New purchase orders will default to the exchange rate at the time the PO is created. The first accounting transaction that converts to the home currency is the inventory receipt. The Inventory Receipt uses the current exchange rate at the time of the Inventory Receipt. This provides a more accurate inventory asset value rather than using the original exchange rate from the purchase order. The exchange rate from the purchase invoice (vendor bill) will finalize the inventory unit cost and asset value from the corresponding inventory receipt.

The gain or loss on currency is created in QuickBooks when you pay the vendor bill. The exchange rate on the funds for the vendor payment does not update the corresponding purchase invoice (bill).

General Ledger Accounts

Most of the General Ledger accounts referenced in Acctivate will be in the Home Currency. Acctivate only requires a separate Accounts Receivable and Accounts Payable account for each currency.